Trading with leverage can wipe your account even faster. It is returned when you close the trade.

Part Time Work From Home Internet Jobs Top 25 Companies Hiring For

With the correct position sizing you can trade across any markets and still manage your risk.

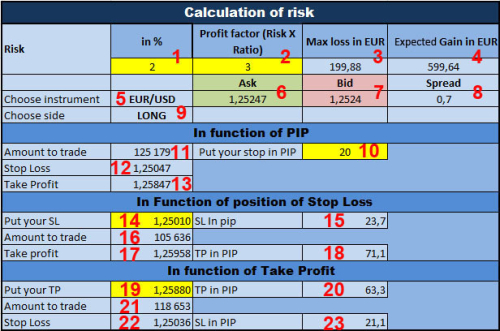

Forex risk formula. If you risk 50 pips on a trade and you set a profit target of 100 pips then your effective risk to reward ratio for the trade would be 12. Never trade with the money that you cannot afford ! to lose. The formula for computing risk vs reward ratio is relatively straightforward.

The number one reason why currency traders lose money. This is now now enter the world wide web and all of a sudden risk can become completely out of control in part due to the speed at which a transaction can take place. You can enter your stoploss size in pips and the percetage of capital youre willing to risk to get how many lots you should be trading.

With the correct position sizing you can trade across any markets and still manage your risk. Forex trading bears intrinsic risks of loss. Forex options futures and cfds are complex instruments and come with a high risk of losing money rapidly due to leverage.

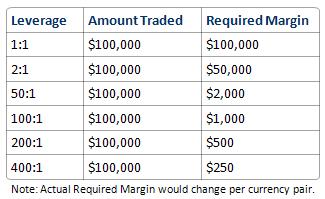

Your risk 50 pips for a reward 100 pips would equal. Covers how to do simple calcs when your acco. The margin that you are putting up is held by the broker for the duration of the trade and cannot be used to take any! other positions.

Itas because they cont! inuously place trades with to high risk. So if your leverage is 4001 then you are putting up 1 to control 400 worth of currency. Here is a very simple excel spreadsheet which calculates your risk.

You should consider whether you understand how cfds work and whether you can afford to take the high risk of losing your money. Next youve learned that forex risk management and position sizing are two sides of the same coin. You must understand that forex trading while potentially profitable can make you lose your money.

Forex risk calculator in lots. 12 risk reward ratio. Leverage in forex primarily refers to the ability to use a certain amount of cash or margin to borrow a larger amount of money.

Lets assume that the beginner already has learned to plan their entry and exits ahead of time. Learn how to manually calculate what lot size you need to trade to lose no more than x of your trading account. Most traders ! begin trading by risking one lot or mini lot for each trade.

What Is A Lot On Forex And How Do You Calculate The Trade Volume On

What Is A Lot On Forex And How Do You Calculate The Trade Volume On

Forex Pip Risk Calculator Forex Exchange Hyderabad Kukatpally

Free Position Size Calculator Risk Management Money Management

Forexiation Diary Of A Perth Forex Trader Risk Of Ruin And

Forexiation Diary Of A Perth Forex Trader Risk Of Ruin And

The Ultimate Beginner S Guide To Forex Backtesting Trading Heroes

Forex21 Calculator Forex Risk Calculator In Lots

How To Calculate Margin In Forex Formula

Forex Pip Calculator Fxpro Semina 2019

Risk Management Forex Calculator Forex Risk Calculator In Lots

Risk Management Forex Calculator Forex Risk Calculator In Lots

Margin Calculator Directly Integrated Into Mt4 Boost Your Trading

Margin Calculator Directly Integrated Into Mt4 Boost Your Trading

Margin In Forex Trading Here S What You Need To Know

Margin In Forex Trading Here S What You Need To Know

Forex Risk Calculator Software

Forex Position Size Formula

Forex Position Size Formula

Pips Price Risk Calculator Forex Jrapp Android Apps Appagg

Risk Reward For! ex Calculator Daspan Forex Pvt Ltd

0 Response to "Forex Risk Formula"

Posting Komentar